FintechZoom Best Credit Cards: Maximize Your Benefits

Introduction

Choosing the right credit card can significantly impact your financial life. With so many options available, understanding how to select the best one for your needs is crucial. In this article, we’ll explore the FintechZoom Best Credit Cards and provide you with tips to maximize your benefits.

Why Credit Cards Matter

Importance of Financial Literacy

Understanding credit cards is essential for making informed financial decisions. Being knowledgeable about credit card benefits can lead to smarter spending and savings.

Overview of Credit Card Issuers

Major companies like Visa, Mastercard, and American Express dominate the credit card market, each offering unique features.

Uses of credit cards

| Use of Credit Cards | Explanation |

|---|---|

| Purchasing Power | Credit cards provide consumers with the ability to make purchases without using cash. This flexibility allows for immediate buying and online transactions. |

| Building Credit History | Regular, responsible use of credit cards helps individuals build a credit history. A positive credit history is essential for loans, mortgages, and other credit-based services. |

| Rewards and Cashbacks | Many credit cards offer rewards such as cashback, points, or miles for purchases. These incentives encourage usage and can be redeemed for goods, services, or discounts. |

| Emergency Spending | In emergencies, such as unexpected car repairs or medical expenses, credit cards can be a financial lifesaver, allowing immediate access to funds without a lengthy approval process. |

| Fraud Protection | Most credit cards come with fraud protection, where consumers are not held responsible for unauthorized charges. This makes them safer than cash or debit cards. |

| Travel Benefits | Credit cards often provide travel-related perks such as insurance coverage, hotel upgrades, and airport lounge access, making them ideal for frequent travelers. |

| Balance Transfers | Some credit cards allow balance transfers, letting users transfer existing debt from one card to another, usually at a lower interest rate, helping manage debt effectively. |

| Convenient Record-Keeping | Credit cards offer detailed statements, making it easy to track spending, manage budgets, and prepare for taxes. Online access adds to this convenience. |

| Interest-Free Period | Many credit cards offer an interest-free period (grace period), typically between 21-55 days. If the balance is paid in full within this time, no interest is charged. |

| Installment Plans | Credit cards often allow users to convert large purchases into monthly installment plans, making big-ticket items more affordable without having to pay all at once. |

| Global Acceptance | Credit cards are widely accepted internationally, making them a convenient payment method for travelers who don’t want to carry large amounts of local currency. |

| Credit Card Offers and Discounts | Many companies partner with credit card providers to offer discounts or special offers when users pay with a specific credit card, providing savings opportunities. |

| Expense Tracking for Businesses | For business owners, credit cards are a valuable tool for tracking expenses, managing employee spending, and simplifying tax reporting and expense reimbursement. |

| Purchase Protection | Some credit cards offer purchase protection, covering items against theft, damage, or loss for a certain period after purchase, adding extra security to buying goods. |

| Interest Charges on Carrying Balance | While credit cards offer flexibility, carrying a balance month-to-month without paying it off can result in high-interest charges, making it important to pay balances promptly. |

How to Choose a Credit Card

Credit Score Requirements for Credit Cards

Your credit score plays a significant role in determining your eligibility for various cards. Knowing where you stand can help you choose wisely.

Annual Fees and Hidden Costs

Some cards come with annual fees, while others don’t. Understanding these costs is essential for making the right choice.

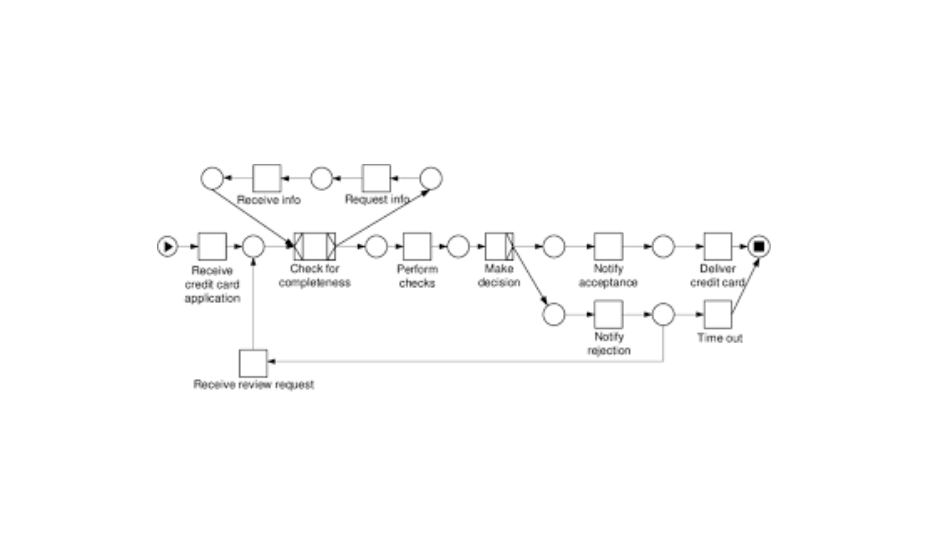

Application Process for Credit Cards

Understanding Credit Cards

Before applying for a credit card, it’s essential to understand what a credit card is and how it works. A credit card allows you to borrow funds from a pre-approved limit to make purchases. The credit card issuer bills you monthly, and you are required to pay back at least a minimum amount. If you pay your balance in full, you can avoid interest charges. Familiarizing yourself with terms such as APR (Annual Percentage Rate), credit limit, and fees is crucial.

Assessing Your Financial Needs

Identifying your financial needs is the next step in the application process. Consider what you plan to use the credit card for—whether it’s everyday purchases, travel, or building credit. Different credit cards offer various rewards, such as cashback, travel points, or discounts on specific purchases. Evaluating your spending habits will help you choose a card that aligns with your financial goals.

Checking Your Credit Score

Your credit score plays a significant role in the credit card application process. Lenders use your credit score to assess your creditworthiness, similar to how investors assess companies in the Fintechzoom Chevron Stock analysis. A higher score generally increases your chances of approval and can qualify you for cards with better rewards and lower interest rates. You can check your credit score through various online services or your bank. Understanding your score will help you gauge which credit cards you may qualify for.

Researching Credit Card Options

Once you have a clear understanding of your needs and credit score, it’s time to research different credit card options, just like analyzing stock market options such as Fintechzoom NVDA Stock for investment. Websites like FintechZoom provide comprehensive comparisons of various credit cards, including features, rewards programs, fees, and interest rates. Look for cards that offer benefits aligned with your spending habits and ensure that you read the fine print regarding fees and interest rates.

Preparing Required Documentation

When applying for a credit card, you’ll need to gather specific documentation. This typically includes personal information such as your name, address, Social Security number, and employment details. You may also need to provide your income information and housing costs. Having this information ready can streamline the application process.

Completing the Application

Most credit card applications can be completed online, making the process quick and convenient. Fill out the application form with the required information. Be honest and accurate, as discrepancies can lead to application denial. Some issuers may also allow you to apply via phone or in-person at a bank branch.

Submitting the Application

After you’ve filled out the application, review it for accuracy before submitting it. Once submitted, the credit card issuer will process your application. This can take anywhere from a few minutes to several days, depending on the issuer and the complexity of your application.

Awaiting Approval

After submission, you will receive notification regarding your application status. Many issuers provide instant approval, while others may require further review, which could take longer. If approved, you will receive your credit card in the mail, often accompanied by important documents outlining the terms and conditions.

Activating Your Card

Upon receiving your card, you’ll need to activate it before use. Activation usually involves calling a number or visiting a website, much like activating and managing accounts on FintechZoom GME Stock platforms. This step is essential to ensure your card is ready for transactions and to protect against fraud.

Managing Your Credit Card Responsibly

Once you have your credit card, Managing it responsibly is vital, just like how investors track the performance of their portfolios on platforms like Fintechzoom Lucid Stock. This includes making timely payments, keeping your balance low relative to your credit limit, and monitoring your account for unauthorized transactions. By doing so, you can build a positive credit history and enjoy the benefits of your credit card.

Top Starter Credit Cards on Fintechzoom

| Credit Card | Expanded Explanation |

|---|---|

| SoFi Credit Cards | SoFi credit cards are ideal for beginners due to their simplicity and robust financial features, similar to the ease of use found in tools such as FintechZoom Best Crypto Wallets for Secure Trading. They offer competitive interest rates, meaning users pay less in interest when carrying a balance.

Additionally, the fees are kept low or non-existent, making it easier to manage expenses. Perks include cell phone protection, which covers damage or theft of mobile devices, and no foreign transaction fees, which is beneficial for international travelers. Moreover, SoFi provides educational resources to help users understand credit management and improve their financial literacy. |

| M1 Owner’s Reward Card | The M1 Owner’s Reward Card is perfect for individuals who want to merge their spending with their investment strategies. It offers rewards that can be directly invested into users’ M1 Finance accounts.

This feature allows cardholders to grow their investment portfolios by simply making purchases. This approach aligns everyday spending with long-term financial goals, making it a great choice for those who are looking to build wealth through consistent investments. |

| Self-Secured Visa | The Self-Secured Visa is designed for individuals looking to establish or rebuild credit. It requires an initial security deposit that sets the credit limit, thus reducing the risk for both the cardholder and the issuer.

This deposit is refundable and can serve as a pathway to improve credit scores over time. By making regular payments, users can demonstrate responsible credit use, which is reported to the major credit bureaus. This helps build or repair credit scores, making it an effective tool for long-term financial improvement. |

| Secured Chime Credit Builder Visa Card | The Secured Chime Credit Builder Visa is tailored for those new to credit or looking to improve their credit score without the hurdles often associated with secured credit cards. Unlike traditional secured cards, there’s no need for a credit check or a security deposit, making it more accessible.

Additionally, the card has no annual fees, meaning users can focus on building their credit profile without worrying about extra costs. This card offers a low-risk way to establish credit history without the typical upfront financial burdens. |

| Petal 2 Visa Credit Card | The Petal 2 Visa Credit Card is specifically designed for individuals with little to no credit history. Instead of relying solely on traditional credit scores, Petal 2 uses alternative data like banking history to assess creditworthiness.

This allows for a broader range of users to qualify. The card also offers potentially higher credit limits than other starter cards, giving users more flexibility. Additionally, it rewards timely payments with cash back, incentivizing responsible credit use while helping to build a solid credit profile. |

| Update Cash Rewards Visa | The Update Cash Rewards Visa is a hybrid card that combines the flexibility of a credit card with the structure of a personal loan. It offers fixed payment schedules and interest rates, helping users avoid the high-interest debt often associated with carrying a balance.

The card also provides cashback rewards on purchases, making it a great option for individuals who want to carry a balance but aim to avoid spiraling into high-interest credit card debt. This card suits those who need structured repayment options with financial rewards. |

| Cred.Ai Unicorn Card | The Cred.Ai Unicorn Card stands out for its innovative approach to personal finance, particularly appealing to tech-savvy users. It includes features such as spending predictions, which help users anticipate and manage their expenses, and automated credit improvement tools.

These features are designed to improve users’ credit scores without any manual effort. Moreover, the card is unsecured, meaning it doesn’t require a deposit, and it operates with no fees, making it an attractive option for beginners looking for a technologically advanced credit card. |

Understanding Credit Card Features

Introductory Offers and Bonuses

Many cards offer attractive sign-up bonuses. Knowing how to take advantage of these offers can enhance your rewards.

Reward Categories

Credit cards typically offer rewards in specific categories like dining, groceries, or travel. Choosing a card that aligns with your spending habits is key.

Points vs. Miles

Understanding the difference between points and miles can help you maximize your rewards. Points are usually more versatile, while miles are often tied to airlines.

Credit Card Benefits and Perks

Cardholder Benefits

Many cards offer added benefits like travel insurance, purchase protection, and extended warranties. These perks can add significant value to your card.

Credit Card Rewards Programs

Each issuer has its rewards program, which can differ in terms of points accumulation and redemption options.

Cash Back vs. Travel Rewards

Understanding your spending patterns can help you decide between cash back and travel rewards.

Maximizing Your Credit Card Rewards

How to Maximize Credit Card Rewards

To make the most of your card, consider strategies like using it for all eligible purchases and taking advantage of bonus categories, much like how investors take advantage of FintechZoom Investment Tips to maximize their returns.

Credit Utilization Ratio

Maintaining a low credit utilization ratio (the amount of credit used compared to your total credit limit) is crucial for maintaining a healthy credit score.

Credit Card Comparison Tools

Credit Card Comparison Tools

Using comparison tools can simplify your search for the best credit cards, allowing you to evaluate multiple options easily.

Consumer Reviews

Reading reviews from other users can provide insights into card performance and customer satisfaction, helping you make an informed choice.

Common Fees Associated with Credit Cards

Fees: Common Fees

Be aware of fees like late payment fees, foreign transaction fees, and balance transfer fees, as these can quickly add up, much like the hidden costs discussed in the Fintechzoom GE Stock Analysis.

Understanding Credit Card Interest Rates

Knowing how interest rates work can help you avoid debt and choose cards with favorable terms, just as knowing market trends like Fintechzoom TSLA Stock helps investors make informed decisions.

Types of credit cards

Standard Credit Cards

- Description: Standard credit cards are the most basic form of credit. They do not offer extra rewards or perks but simply allow users to borrow funds up to a preset limit and pay them back with interest over time.

- Features:

- No additional rewards or bonuses.

- Typically comes with basic interest rates and fees.

- Suitable for individuals who prefer simplicity and want to focus solely on using credit.

Rewards Credit Cards

- Description: TRewards Credit Cards: These cards offer various rewards to users based on their spending, similar to the financial benefits explored in Money Fintechzoom.

- Features:

- Earn points or cashback on purchases.

- Some cards offer double or triple points for specific categories like groceries or gas.

- May include sign-up bonuses for new cardholders who spend a certain amount in the first few months.

Cashback Credit Cards

- Description: Cashback cards allow users to earn a percentage of their spending back as cash. The percentage usually ranges between 1% and 5%, depending on the category of purchase.

- Features:

- Offers cash rebates on spending, typically credited to the card account.

- Some cards offer rotating bonus categories where higher cashback percentages can be earned.

- Rewards can be redeemed as statement credits, direct deposits, or checks.

Travel Credit Cards

- Description: Travel credit cards are designed for individuals who travel frequently. They offer rewards in the form of points or miles that can be redeemed for flights, hotel stays, and other travel-related expenses.

- Features:

- Earn points or miles for travel expenses like airfare, hotels, and car rentals.

- May offer additional travel perks such as free checked bags, priority boarding, or access to airport lounges.

- Some cards waive foreign transaction fees, making them ideal for international travel.

Balance Transfer Credit Cards

- Description: Balance transfer cards allow users to transfer high-interest debt from one or more credit cards to a card with a lower interest rate or a 0% introductory APR for a specified period.

- Features:

- Low or 0% interest on balance transfers for an introductory period (usually 6-18 months).

- Ideal for consolidating credit card debt and reducing interest payments.

- Often comes with a balance transfer fee (typically 3%-5% of the transferred amount).

Secured Credit Cards

- Description: Secured credit cards require the cardholder to make a cash deposit, which serves as collateral and sets the credit limit. These are typically used by individuals with poor or no credit history to build or rebuild credit.

- Features:

- Requires a security deposit, typically equal to the credit limit.

- Often used as a credit-building tool.

- Responsible use may lead to an upgrade to an unsecured card.

Student Credit Cards

- Description: Student credit cards are designed for college students who are just beginning to build their credit history. These cards often have lower credit limits and fewer rewards compared to other types of credit cards.

- Features:

- Lower credit limits, making them suitable for first-time credit users.

- May offer rewards and benefits geared toward students, such as cashback on textbooks or food purchases.

- Easier approval criteria compared to regular credit cards.

Business Credit Cards

- Description: Business credit cards are tailored for entrepreneurs and business owners. They offer rewards and benefits related to business expenses and can help keep personal and business finances separate.

- Features:

- Offers higher credit limits suited for business spending.

- Earn rewards for business-related purchases, such as office supplies, travel, or advertising.

- Provides tools for managing employee cards and tracking expenses.

Store Credit Cards

- Description: Store credit cards are issued by retailers and can only be used at their stores or affiliated businesses. These cards often offer discounts or special financing options for store purchases.

- Features:

- Limited use, typically restricted to specific retailers.

- May offer discounts, special offers, or exclusive promotions for cardholders.

- Higher interest rates compared to general-purpose credit cards.

Premium Credit Cards

- Description: Premium credit cards, also known as luxury cards, offer high-end rewards and exclusive perks but often come with high annual fees. They are designed for individuals who spend a lot and want access to premium services.

- Features:

- Exclusive rewards such as airport lounge access, travel insurance, and concierge services.

- High annual fees, sometimes exceeding $500.

- Targeted toward high-income individuals who can take full advantage of the benefits.

Charge Cards

- Description: Unlike regular credit cards, charge cards do not have a preset spending limit, but the balance must be paid in full each month. These cards are usually offered to individuals or businesses with strong credit profiles.

- Features:

- No preset spending limit, allowing for more flexibility in purchases.

- Requires full payment of the balance each month.

- No interest charges but may incur late fees if payments are not made on time.

Low-Interest Credit Cards

- Description: Low-interest credit cards offer a lower-than-average APR (annual percentage rate) on purchases. These cards are beneficial for people who tend to carry a balance and want to minimize interest costs.

- Features:

- Lower APR compared to standard credit cards.

- May offer 0% introductory rates on purchases for a specified period.

- Ideal for individuals who anticipate carrying a balance from month to month.

Benefits of Multiple Cards

Multiple credit cards can offer various benefits, such as increased rewards, promotional offers, and different protections. You can strategically use each card for specific purchases to optimize rewards and benefits.

Security Measures for FintechZoom Credit Cards

Encryption Technology

FintechZoom employs advanced encryption technologies to protect user data. This means that sensitive information, such as card numbers and personal details, is transformed into a coded format that is unreadable to unauthorized users. Such encryption helps ensure that data breaches are minimized and that transactions are secure.

Two-Factor Authentication (2FA)

To enhance account security, FintechZoom often implements two-factor authentication. This process requires users to provide two forms of identification before accessing their accounts or completing transactions. For instance, users may need to enter a password and then verify their identity through a code sent to their mobile device, adding an extra layer of protection against unauthorized access.

Fraud Detection Systems

FintechZoom utilizes sophisticated fraud detection systems that monitor transactions in real time. These systems analyze patterns and flag any suspicious activity, which can help prevent fraudulent transactions before they occur. If a transaction appears unusual, the system may prompt the user for additional verification, further safeguarding their accounts.

Data Breach Response Protocols

In the event of a data breach, FintechZoom has established response protocols. This includes immediate notifications to affected users and steps to mitigate the breach’s impact. They also provide guidance on monitoring accounts for suspicious activity and how to protect personal information in the aftermath of a breach.

Legality of FintechZoom Credit Cards

Regulatory Compliance:

FintechZoom credit cards operate in compliance with relevant financial regulations and laws. This includes adherence to guidelines set by financial authorities, such as the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) in the U.S. These regulations ensure that consumers are protected and that companies operate transparently and ethically.

Consumer Protection Laws:

The legality of FintechZoom credit cards is also supported by consumer protection laws that safeguard users’ rights. These laws often include provisions for dispute resolution, protections against unauthorized transactions, and requirements for clear disclosures regarding fees and interest rates.

Licensing and Registration:

FintechZoom may be required to obtain specific licenses and registrations to operate as a credit card issuer. This licensing process ensures that the company meets certain financial standards and is accountable to regulatory bodies. Consumers can have confidence that FintechZoom operates within a legal framework designed to protect their interests.

Privacy Policies

The legality of FintechZoom credit cards is supported by stringent privacy policies that dictate how user data is collected, used, and shared. These policies are designed to comply with privacy laws, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S.

Users are informed about their rights regarding their data, ensuring transparency in data handling practices.

Which company’s credit card is best?

Chase

Chase credit cards are renowned for their generous rewards programs, particularly the Chase Ultimate Rewards system. Cards like the Chase Sapphire Preferred are ideal for travelers, offering bonus points on travel and dining purchases, and valuable sign-up bonuses. Chase also has a range of no-annual-fee cards and options for building credit, making it versatile for different users.

American Express

American Express cards often come with robust benefits for those who travel frequently. Cards such as the Amex Platinum provide perks like access to airport lounges, travel insurance, and exclusive experiences. While they typically have higher annual fees, the rewards and benefits can outweigh the costs for those who maximize their use, especially in travel and dining categories.

Capital One

Capital One is known for its straightforward rewards system and a variety of cards tailored to different needs. The Capital One Venture Rewards card is a popular choice among travelers, offering miles on every purchase and flexible redemption options. They also have no foreign transaction fees, making them a good choice for international travelers.

Discover

Discover is often celebrated for its cash-back programs, particularly the rotating categories that offer 5% cash back on certain purchases each quarter. Their cards have no annual fees and provide access to FICO credit scores, which is beneficial for monitoring credit health. Discover also emphasizes customer service and offers a variety of educational resources for cardholders.

Citi

Citi credit cards cater to a wide range of consumers, from cash-back earners to travelers. The Citi Double Cash card is notable for its simple cash-back structure: earn 1% when you buy and another 1% when you pay. For travelers, the Citi Premier card offers extensive travel rewards and benefits. Additionally, Citi often runs promotional balance transfer offers, which can help those looking to manage debt.

Bank of America

Bank of America offers a variety of credit cards, including cash-back and travel rewards options. The Bank of America Customized Cash Rewards card allows users to choose their 3% cash-back category, providing flexibility. Moreover, customers with a Bank of America checking or savings account may benefit from lower fees or enhanced rewards.

Which credit card is the highest tier?

The premium credit cards are frequently referred to as “luxury” or “elite” cards. Cards such as the American Express Centurion Card offer special benefits like limitless lounge access, luxury gifts, and premier status with hotels and airlines; nevertheless, these cards are usually only available by invitation and come with hefty fees.

Which American credit card has the most power?

Some of the strongest credit cards available in the United States include the Chase Sapphire Reserve and the American Express Platinum. They provide substantial sign-up bonuses, great reward rates, and a plethora of travel benefits.

Which three credit companies are the best?

Equifax, Experian, and TransUnion are the top three credit reporting companies in the US. Lenders utilize credit reports and scores provided by these companies, which gather personal credit data, to determine an applicant’s creditworthiness.

What is included in fintech?

Fintech encompasses a wide range of financial operations, including online and mobile banking, blockchain technology, cryptocurrencies, crowdfunding, automated online investment, and mobile payments.

Conclusion

In conclusion, choosing the right credit card and managing it wisely can lead to significant financial benefits. By understanding the different types of cards, analyzing fees, and leveraging rewards programs, you can enhance your financial health. Remember to stay informed through resources like FintechZoom to continually make the best financial decisions.

FAQs, FintechZoom Best Credit Cards

1. What is FintechZoom, and why should I trust their credit card recommendations?

FintechZoom is a reputable platform that provides insights, reviews, and expert analysis on financial products, including credit cards. Their recommendations are based on a thorough evaluation of card features, benefits, fees, and user reviews, making it a trusted source for selecting the best credit cards.

2. How does FintechZoom determine the best credit cards?

FintechZoom evaluates credit cards based on several factors, including rewards programs, interest rates, annual fees, introductory offers, customer service, and cardholder benefits. They also consider user feedback and industry trends to ensure their recommendations are up to date.

3. What types of credit cards are featured in FintechZoom’s best credit card list?

FintechZoom covers a wide variety of credit card categories, including rewards cards, cashback cards, travel cards, balance transfer cards, and cards for building credit. They aim to provide options suitable for different financial goals and credit profiles.

4. Can I find credit cards for bad credit on FintechZoom’s best credit card list?

Yes, FintechZoom provides recommendations for secured credit cards and other options designed for individuals with poor or limited credit history, helping users improve their credit score over time.

5. What are the top benefits of using FintechZoom’s best credit card recommendations?

By using FintechZoom’s recommendations, you can easily compare top-rated credit cards, find cards with the best rewards or lowest fees, and make informed decisions based on your financial goals. The platform also helps you save time by curating cards that fit different spending habits and preferences.