Carta Cap Table Management Review: A 1 Comprehensive Overview

Introduction

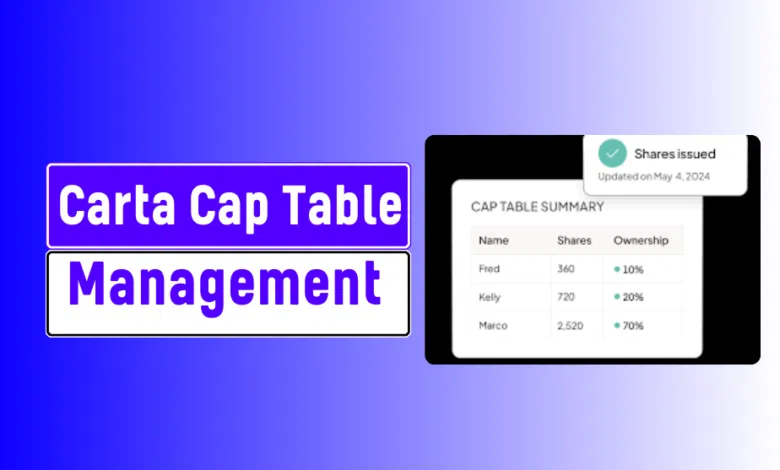

Managing equity in a startup can be challenging, especially as the business grows. With multiple stakeholders, investors, and equity distributions to track, startups need reliable cap table management solutions.

One of the most widely known platforms for this is Carta, an equity management software designed to simplify how startups handle their cap tables, shares, and ownership structures. This review provides an in-depth look into Carta’s cap table management features, pricing, security, and much more.

What is Carta Cap Table Management?

Carta is a powerful equity management platform that helps businesses manage their cap tables, shares, stakeholders, and funding. With features aimed at startups, Carta streamlines the management of equity by automating reporting, ensuring compliance, and tracking ownership stakes.

Why Cap Table Management is Crucial for Startups

Cap table management refers to the process of tracking a company’s shares, investors, and equity ownership. For startups, having an accurate and up-to-date cap table is essential to securing future rounds of funding and ensuring all stakeholders are aware of their ownership stakes.

Carta: A Leader in Equity Management Software

Carta is widely regarded as one of the best cap table management tools available today. Its intuitive interface, combined with robust features such as equity tracking, investor relations, and legal compliance, makes it a valuable resource for businesses of all sizes, particularly startups looking to scale.

Key Features of Carta Cap Table Management

1. Comprehensive Dashboard

- Overview of Cap Table: Carta’s dashboard provides a consolidated view of a startup’s cap table, making it easy for founders to see the entire ownership structure at a glance. This feature is especially useful for tracking how equity is distributed among founders, investors, and employees.

- Real-Time Data: The dashboard updates in real-time, ensuring that all data regarding shares, equity stakes, and valuations is current. This helps in making informed decisions quickly, without the need for manual updates or corrections.

- Critical Metrics: Founders can easily access critical metrics such as ownership percentages, share classes, and dilution effects. This visibility helps in strategic planning and financial forecasting.

2. Equity Tracking

- Centralized Information: Carta’s equity tracking feature centralizes all equity-related data in one platform. This means that as new investors come on board or as shares are issued, the information is updated and accessible from a single source.

- Real-Time Updates: The feature provides real-time updates on equity changes, such as new share issuances, transfers, or buybacks. This ensures that all stakeholders are always informed about the latest changes in ownership.

- Detailed Insights: Carta’s tracking system offers detailed insights into each shareholder’s stake and history. This includes the number of shares owned, the type of shares, and the impact of any recent transactions on their ownership percentage.

3. Automated Reporting

- Efficient Report Generation: Carta automates the generation of various reports, including equity summaries, investor reports, and compliance documents. This automation reduces the manual effort required to compile and distribute these reports.

- Regulatory Compliance: Automated reporting ensures that startups comply with legal and regulatory requirements. Carta generates reports that meet industry standards and regulatory guidelines, reducing the risk of non-compliance.

- Customizable Reports: Users can customize reports to meet specific needs, such as detailed financial summaries or investor updates. This flexibility helps in addressing different reporting requirements and stakeholder interests.

4. Scalability for Growing Startups

- Adaptability to Growth: Carta is built to scale with the growth of a startup. As a company adds more investors or undergoes multiple funding rounds, Carta can handle the increasing complexity of the cap table.

- Seamless Upgrades: The platform allows startups to seamlessly upgrade their plan or features as they grow. This means that startups can start with basic features and gradually move to more advanced options as their needs evolve.

- Management of Increasing Data: Carta efficiently manages larger volumes of data, including more complex equity structures and additional stakeholders, without compromising performance or usability.

5. Investor Relations Management

- Streamlined Communication: Carta provides tools to streamline communication between startups and their investors. This includes automated updates on company performance, equity changes, and upcoming events.

- Investor Access: Investors can access their own dashboards to view their holdings, track performance, and receive updates directly. This transparency helps build trust and keeps investors engaged.

- Feedback and Queries: The platform also facilitates easy communication for investors to provide feedback or raise queries, which helps in maintaining a good relationship and addressing any concerns promptly.

6. Valuation Tracking

- Real-Time Valuation Updates: Carta allows startups to track and update their company’s valuation in real-time. This is crucial during fundraising rounds, as accurate and current valuation data helps in negotiations with potential investors.

- Historical Valuation Data: The platform maintains a history of valuation changes, which can be useful for analyzing trends, understanding the impact of funding rounds, and making strategic decisions.

- Integration with Financial Models: Carta’s valuation tracking integrates with financial models and projections, providing a comprehensive view of the company’s financial health and aiding in long-term planning.

7. Security Features

- Data Encryption: Carta employs top-tier data encryption methods to protect sensitive equity and financial information. This ensures that all data stored on the platform is secure from unauthorized access.

- Secure Storage: All equity management documents and records are stored securely on Carta’s platform. This secure storage is crucial for safeguarding important financial and ownership information.

- Access Controls: The platform includes robust access controls, allowing startups to define who can view or edit different parts of the cap table. This ensures that only authorized personnel have access to sensitive data.

Benefits of Using Carta Cap Table Management

1. Simplifies Complex Equity Management

Managing equity can be challenging, but Carta simplifies this process by automating key tasks like reporting, compliance, and stakeholder tracking.

2. Easy Integration with Other Tools

Carta easily integrates with other platforms, such as legal and HR tools, making it a seamless part of a startup’s broader tech stack.

3. Improved Compliance

Carta ensures startups remain compliant with legal regulations, such as reporting requirements and equity distribution rules, saving businesses from costly legal issues.

4. Investor-Friendly Features

Investors can log into Carta to access real-time information about their holdings, funding rounds, and the company’s cap table. This fosters transparency and trust.

5. Automation for Time Savings

Carta’s automation features allow startups to focus on growth rather than tedious manual processes related to cap table management.

Carta vs. Pulley: A Cap Table Management Comparison

When comparing Carta to other cap table management tools like Pulley, Carta often stands out due to its comprehensive feature set and scalability. While both platforms offer robust equity management, Carta’s automation and integration features give it an edge for fast-growing startups.

Carta Cap Table Pricing

Carta offers flexible pricing plans that cater to startups of all sizes. While specific pricing details may vary, most plans are based on the size and complexity of your cap table. Startups can choose from basic, standard, and premium plans based on their needs. The best cap table software in 2024 offer competitive pricing with features that scale as the company grows.

Carta Cap Table Management for Investors

Investors also benefit from Carta’s cap table management solutions. They can access real-time updates on their investments, view current ownership stakes, and analyze a company’s growth metrics. This transparency strengthens relationships between startups and their investors.

How to Manage Equity with Carta

Managing equity with Carta is straightforward. The platform automates many of the tasks associated with equity management, such as issuing shares, updating cap tables, and reporting to investors. With Carta, startups can easily track ownership stakes and ensure their equity structure is up-to-date.

Streamlining Equity with Carta

Carta is built to streamline the equity management process. Startups no longer need to rely on complex spreadsheets or manual updates to their cap tables. With Carta, everything is automated and stored securely, giving founders peace of mind.

Carta’s Security Features

Given the sensitive nature of equity and ownership data, Carta prioritizes security. The platform uses advanced encryption and access controls to ensure only authorized users can view and update cap table information.

Carta Integration with Other Tools

Carta integrates seamlessly with a variety of other tools, including accounting software, legal platforms, and HR systems. This makes it easy for startups to manage all aspects of their business in one place, without the need for multiple disconnected systems.

Automating Equity Management with Carta

One of the key advantages of using Carta is the ability to automate equity management. From issuing shares to updating the cap table after each round of funding, Carta automates many of the processes that traditionally required manual intervention.

Cap Table Management for Investors: A Closer Look

Carta’s cap table management tools are designed with investors in mind. Investors can log in to view their stakes, track company growth, and receive updates on funding rounds. This transparency builds trust between companies and their investors.

Carta Cap Table Management: Pros and Cons

Pros

- User-Friendly Dashboard

- Description: Carta’s dashboard is designed with simplicity and ease of use in mind. It provides a clear, intuitive interface that displays all crucial information related to equity management, including ownership stakes, share distribution, and investment details.

- Benefits: The user-friendly design ensures that users can quickly access and understand their cap table, reducing the time spent navigating complex features. This simplicity is particularly beneficial for startups with limited administrative resources.

- Automation Reduces Manual Work

- Description: One of Carta’s significant advantages is its automation capabilities. Tasks such as updating the cap table after funding rounds, issuing shares, and generating reports are automated.

- Benefits: Automation minimizes the risk of human error, speeds up routine processes, and frees up time for startups to focus on other critical areas. It ensures accuracy and consistency in managing equity data without requiring extensive manual input.

- Excellent Security Features

- Description: Carta prioritizes the security of sensitive financial and equity data. It employs advanced encryption methods, secure data storage, and rigorous access controls.

- Benefits: These security measures protect against unauthorized access and data breaches, ensuring that confidential information about equity and ownership is safe. For startups handling sensitive investor information, this level of security is crucial.

- Scalable as the Company Grows

- Description: Carta’s platform is built to scale with your business. Whether you’re a small startup or a rapidly growing company, Carta can accommodate increasing complexity in your cap table.

- Benefits: As your company grows and you add more investors or issue additional shares, Carta can handle the increased data and complexity without compromising performance. This scalability means that startups won’t need to switch platforms as they expand.

- Integration with Other Business Tools

- Description: Carta integrates with a range of other business tools, such as accounting software, legal platforms, and HR systems.

- Benefits: This integration ensures a seamless flow of information across different business functions, reducing the need for duplicate data entry and enhancing overall efficiency. It helps maintain consistency and accuracy in managing various aspects of the business.

Cons

- Pricing May Be Steep for Early-Stage Startups

- Description: Carta’s pricing structure might be considered high, especially for early-stage startups with limited budgets. The cost can increase based on the number of users, shares, and the level of features required.

- Drawbacks: For startups operating on a tight budget, the cost of Carta might be a significant consideration. While the platform offers many benefits, smaller businesses may need to evaluate if the investment aligns with their financial capabilities.

- Learning Curve for New Users

- Description: Although Carta is designed to be user-friendly, new users may still face a learning curve when first using the platform. Understanding all the features and functionalities can take time.

- Drawbacks: Startups with limited experience in equity management might find the initial setup and navigation challenging. This learning curve could temporarily slow down the adoption process and may require additional time or training.

Best Cap Table Tools for 2024: Why Carta Stands Out

Carta remains one of the best cap table tools in 2024 because of its robust feature set, automation, and scalability. Startups that need a reliable and secure platform for managing equity should consider Carta as a top choice.

Carta Software Benefits for Startups

Startups benefit greatly from using Carta for cap table management. The platform simplifies the management of shares, investors, and equity distribution. It’s a must-have tool for businesses looking to streamline equity management and stay compliant.

How Carta Helps Streamline Startup Funding

Managing equity during funding rounds can be complex. Carta simplifies this process by providing real-time updates to the cap table and automating the issuing of new shares to investors. This ensures accuracy and transparency throughout the funding process.

Carta for Stakeholders and Ownership Tracking

Carta helps startups keep track of all stakeholders and their ownership stakes. The platform allows founders to easily update cap tables and communicate changes to all stakeholders, ensuring everyone remains informed.

Conclusion

In conclusion, Carta is a powerful and comprehensive tool for managing equity, cap tables, and investor relations. Its automation, security, and scalability make it an excellent choice for startups looking to streamline their equity management processes. Whether you’re a small startup or a growing business with multiple investors, Carta offers the tools you need to manage your equity with ease.

FAQ About Carta Cap Table Management

What is Carta Cap Table Management?

Carta is a leading platform that helps startups and companies manage their cap tables, equity, and ownership structure. It streamlines tasks like issuing shares, tracking employee equity, and maintaining compliance.

How does Carta simplify cap table management?

Carta automates key cap table tasks, including issuing and tracking shares, managing equity grants, and generating reports. This reduces the risk of errors and ensures accuracy in ownership records.

What are the key features of Carta Cap Table Management?

Some key features include cap table automation, compliance management, 409A valuations, scenario modeling, employee equity tracking, and shareholder communication tools.

What are the pros and cons of using Carta for cap table management?

Pros: User-friendly interface, robust feature set, automated cap table tracking, compliance tools, and excellent customer support.

Cons: Pricing can be high for smaller startups, and some users may find advanced features complex to use initially.

One Comment