FintechZoom GE Stock Analysis: Latest Market Trends

Introduction

The landscape of stock market investment is always evolving, and General Electric (GE) remains a notable player in this arena. In this FintechZoom GE Stock Analysis, we will delve into the latest market trends, performance metrics, and future outlook for GE stock.

GE Stock Overview

General Electric is a diversified multinational corporation known for its significant contributions to various sectors, including aviation, healthcare, and renewable energy. This GE stock analysis will provide insights into its current market standing and performance.

General Electric (GE) Company Profile

Founded in 1892, General Electric has a rich history of innovation. Today, the company operates in over 180 countries, focusing on technological advancements that cater to various industries. Understanding GE’s core business operations is crucial to analyze its stock performance accurately, just as understanding the fintechzoom chevron stock can offer insights into energy sector stocks.

Understanding the Basics of GE Stock

Company Overview

General Electric (GE) is a multinational conglomerate based in the United States, primarily involved in sectors such as aviation, healthcare, renewable energy, and power. Established in 1892, GE has a rich history of innovation and development, playing a significant role in technological advancements.

Understanding the scope and operations of GE is crucial as it impacts the stock’s performance, similar to how insights from FintechZoom NVDA Stock can help investors make informed decisions in the tech industry.

Stock Market Fundamentals

Stocks represent ownership in a company and are bought and sold on stock exchanges, whether it’s fintechzoom tsla stock in the electric vehicle market or GE in conglomerates. GE stock, like other publicly traded companies, can be purchased by investors to gain a stake in the company. The stock market’s movement can be influenced by a variety of factors, including economic conditions, investor sentiment, and company performance, which all contribute to the volatility and price fluctuations of GE stock.

Historical Performance

Examining the historical performance of GE stock provides insights into its trends over time. The stock has experienced significant highs and lows, reflecting various internal and external challenges, including management changes and market conditions. Historical data helps investors assess the stock’s risk and potential for future growth, just as reviewing Fintechzoom GME Stock trends helps with understanding market volatility.

Financial Health

A key aspect of understanding GE stock involves evaluating the company’s financial health, similar to how Money Fintechzoom provides insights into financial strategies for stable investments. This includes analyzing key financial statements such as income statements, balance sheets, and cash flow statements. Metrics like revenue, profit margins, and debt levels give investors a clearer picture of how well the company is managing its resources and generating returns.

Dividends

Dividends are a portion of a company’s earnings paid to shareholders. Historically, GE has been known for paying dividends, which can be a significant aspect for investors seeking income. Understanding the company’s dividend policy is vital for evaluating the attractiveness of GE stock, just as learning about the dividend performance of Fintechzoom.com FTSE 100 can offer insights into international stock comparisons.

Market Position and Competition

GE operates in highly competitive industries, facing challenges from other conglomerates and specialized companies, similar to Fintechzoom Lucid Stock in the electric vehicle sector. Analyzing its market position, strengths, weaknesses, and competitive advantages is essential for understanding its potential for growth and the risks associated with investing in GE stock.

Recent Developments

Keeping up with recent developments can affect GE’s stock performance, just like tracking the latest insights on Fintechzoom Apple Stock helps investors in the tech sector stay ahead. such as changes in leadership, strategic shifts, or significant contracts, can affect GE’s stock performance. News related to innovations in their sectors or economic impacts can also play a crucial role. Staying informed about these developments helps investors make timely decisions.

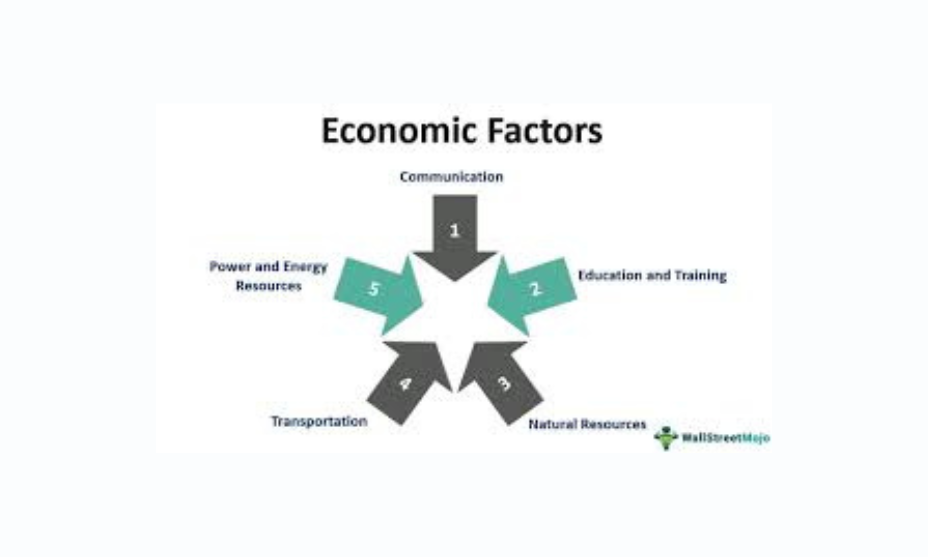

Economic Factors

Macro-economic factors such as interest rates, inflation, and global market trends significantly impact GE stock. Understanding how these factors affect not just GE, but the sectors it operates in, can provide deeper insights into its stock’s potential performance.

Investment Considerations

When considering investing in GE stock, it’s essential to evaluate personal investment goals, risk tolerance, and time horizon. Similarly, resources like Fintechzoom Pro can help guide overall investment strategies. Each investor may have different criteria for what makes a stock suitable, and GE’s unique characteristics must align with these personal strategies.

Analyst Opinions and Ratings

Investors often look at analyst ratings and recommendations to gauge market sentiment. For example, insights from FintechZoom Best Forex Broker can also guide those investing in foreign exchange markets. regarding GE stock. These insights can be based on various analyses, including fundamental and technical assessments, and can guide investment decisions. Understanding the consensus among analysts can provide a broader perspective on the stock’s potential.

how to buy sell FintechZoom GE Stock

Research and Analysis

Before investing in GE stock, conduct thorough research. Start by reviewing the company’s financial health, earnings reports, and market position, similar to how you would analyze fintechzoom amc stock for trends in the entertainment sector. Look at key indicators like revenue growth, profit margins, and debt levels. Analyze recent news affecting the company, including management changes or regulatory developments. Use various financial tools and resources, such as stock analysis platforms, to evaluate market trends and forecasts.

Choosing a Brokerage Account

Selecting the right brokerage is crucial. Look for a platform that aligns with your trading style and investment goals. Factors to consider include commission fees, ease of use, trading tools, and educational resources. Popular options include online brokers like Robinhood, E*TRADE, and TD Ameritrade. If you’re new to investing, a brokerage with strong educational support can be particularly beneficial.

Creating an Account

Once you’ve selected a brokerage, you’ll need to create an account. This process usually involves providing personal information, including your name, address, Social Security number, and employment details. Some brokerages may require a minimum deposit to open an account. Ensure your account is properly funded before proceeding with trades.

Understanding Stock Orders

Familiarize yourself with different types of stock orders. The two main types are market orders, which buy or sell stock at the current market price, and limit orders, which set a specific price at which you’re willing to buy or sell. Understanding these can help you execute trades effectively and at your desired price point.

Buying GE Stock

To buy GE stock, navigate to the trading section of your brokerage platform. Enter the stock’s ticker symbol (GE) and specify the number of shares you wish to purchase. If you’re using a limit order, set your desired price. Review your order before submitting it. After confirming, the order will be processed, and you’ll receive a confirmation of the transaction.

Monitoring Your Investment

After purchasing GE stock, keep an eye on your investment. Monitor the stock’s performance, market conditions, and any news that may impact its value. Many brokerages offer tools to track performance and set alerts for price changes. This ongoing monitoring will help you make informed decisions about holding or selling your shares.

Deciding When to Sell

Determining when to sell GE stock is a critical decision. Factors to consider include your investment goals, market trends, and the company’s financial health. You might choose to sell when the stock reaches a certain price, if it underperforms, or to take profits after a significant gain. Establishing a clear strategy ahead of time can help remove emotion from the decision-making process.

Executing a Sell Order

To sell your GE stock, go back to your brokerage platform. Enter the ticker symbol (GE) and the number of shares you wish to sell. Choose between a market or limit order based on your strategy. Review the details and confirm your order. Once processed, you’ll receive a confirmation of the sale and your account will be updated accordingly.

Tax Implications and Record Keeping

Keep track of your transactions for tax purposes. Profits from selling stocks may be subject to capital gains tax, depending on how long you held the stock. If you held it for more than a year, you might qualify for lower long-term capital gains rates. Consult a tax professional to ensure you understand the implications of your trades and maintain accurate records.

Continuous Learning

The stock market is dynamic, and continuous education is key to becoming a successful investor. Read books, take online courses, and follow financial news to stay informed about market trends and investment strategies. For example, browsing FintechZoom: Investment Tips can offer practical advice to boost your knowledge. Engaging with online investment communities can also provide valuable insights and perspectives.

What does the P/E ratio of GE indicate?

P/E Ratio Overview

The Price-to-Earnings (P/E) ratio is a crucial financial metric used by investors to evaluate the relative value of a company’s shares. Understanding ratios like these is important for both established giants like GE and newer players like Fintechzoom NVDA Stock. It is calculated by dividing the market price per share by the earnings per share (EPS). This ratio helps investors understand how much they are willing to pay for each dollar of a company’s earnings.

GE’s Current P/E Ratio

As of the latest data, GE has a P/E ratio of 55.04. This means that investors are willing to pay $55.04 for every $1 of earnings the company generates. Such a high P/E ratio can indicate several important factors about market sentiment and the company’s financial health.

Implications of a High P/E Ratio

A P/E ratio of 55.04 suggests that the market has high expectations for GE’s future growth. Investors may believe that the company is positioned for significant earnings increases in the coming years. This optimism can be driven by several factors, including innovative products, strong market presence, or positive industry trends that GE is likely to capitalize on.

Valuation Considerations

However, a high P/E ratio also indicates that the stock may be overvalued compared to its earnings. While investors are showing confidence in GE’s future prospects, they are also paying a premium for the stock. This can be a double-edged sword: if GE fails to meet the high earnings expectations, the stock price could decline sharply as investors adjust their valuations.

Market Sentiment vs. Fundamental Value

In essence, while the P/E ratio reflects investor confidence, it is essential to consider it in the context of the company’s fundamentals. A high P/E ratio may indicate that the stock is not a bargain; investors might be better off looking for stocks with lower P/E ratios that still show potential for growth.

Investors should always conduct thorough research, analyzing GE’s business model, competitive landscape, and industry conditions to assess whether the high P/E ratio aligns with the company’s actual performance and future prospects.

How often should I check GE stock updates on Fintechzoom?

Weekly Monitoring

Checking GE stock updates weekly allows you to keep abreast of any significant fluctuations or trends without overwhelming yourself. This frequency strikes a balance, enabling you to absorb essential information while giving the stock time to react to market movements.

During these weekly reviews, you can assess overall performance, look for patterns, and analyze market sentiment surrounding the stock.

Bi-Weekly Reviews

For those who prefer a more relaxed approach, a bi-weekly check can suffice. This method still provides a reasonable overview of GE’s stock performance while reducing the time spent on frequent updates.

It’s especially useful if you’re managing a diversified portfolio and need to focus on multiple stocks. Every two weeks, you can evaluate the stock’s position in relation to broader market trends and news events that may influence its price.

Setting Up Alerts

To enhance your monitoring process, setting up alerts on Fintechzoom can be incredibly beneficial. These alerts can notify you of real-time changes in GE stock, such as price movements, trading volume spikes, or significant news releases.

This feature ensures you won’t miss crucial updates, allowing you to react quickly to market changes without the need for constant manual checks.

Importance of Staying Informed

Staying updated on significant changes, such as earnings reports, management announcements, or macroeconomic indicators, can greatly influence stock performance. By regularly monitoring the stock, you’re better positioned to make informed decisions regarding buying, holding, or selling shares.

Being aware of news that could affect GE’s business—like new product launches or regulatory changes—can also provide insights into potential price movements.

Market Sentiment Analysis

Frequent updates allow you to gauge market sentiment and investor reactions to news related to GE. Understanding how other investors perceive the stock can be critical, especially in volatile market conditions. Regularly checking updates helps you capture shifts in sentiment that may not be reflected in the stock price immediately.

Long-Term Strategy Considerations

Ultimately, your checking frequency should align with your investment strategy. If you’re a long-term investor, you might focus less on daily fluctuations and more on overall trends. However, if you’re actively trading, more frequent updates will be necessary. Adjusting your monitoring schedule according to your investment goals ensures that you stay engaged without becoming overwhelmed.

What is the future outlook for GE, according to experts?

Financial Stability and Growth

Experts suggest that GE’s financial health is showing signs of improvement following its restructuring efforts. The company has streamlined its operations by divesting non-core businesses and focusing on sectors like renewable energy, aviation, and healthcare.

Analysts predict that these strategic shifts will lead to more stable revenue streams and improved profit margins, similar to what is expected from emerging tech stocks like Fintechzoom Lucid Stock. The expectation is that GE will gradually return to consistent profitability, bolstered by cost-cutting measures and operational efficiencies.

Focus on Renewable Energy

With a growing global emphasis on sustainability and reducing carbon footprints, GE is well-positioned in the renewable energy sector. Analysts highlight GE’s investments in wind and solar energy technologies, which are expected to drive significant growth in the coming years.

The shift towards green energy solutions is anticipated to align with government policies and consumer preferences, providing GE with opportunities to expand its market share and enhance its reputation as a leader in sustainable technologies.

Aviation Sector Recovery

The aviation industry is recovering from the impacts of the COVID-19 pandemic, and GE’s aviation segment is poised to benefit significantly. Experts forecast increased demand for commercial aircraft and related services, leading to higher revenues for GE.

The company’s advancements in jet engine technology and its strong backlog of orders are seen as indicators of a robust recovery trajectory. Analysts believe that as global travel resumes, GE’s aviation division will play a crucial role in its overall growth strategy.

Healthcare Innovations

In the healthcare sector, GE is making strides in medical imaging and diagnostics. Experts point out that the ongoing demand for advanced healthcare solutions, particularly in areas like telehealth and personalized medicine, positions GE favorably.

Analysts predict that innovations in medical technology will contribute to sustained growth in GE’s healthcare division, driven by the need for efficient and accurate diagnostic tools in an evolving healthcare landscape.

Challenges and Competition

Despite the positive outlook, experts caution that GE faces significant challenges, including intense competition and potential supply chain disruptions. Rivals in the energy and aviation sectors are innovating rapidly, which could pressure GE to accelerate its development efforts.

Additionally, fluctuations in global markets and geopolitical tensions may pose risks to GE’s growth strategies. Analysts recommend that GE must remain agile and adaptive to navigate these challenges effectively.

Investment in Technology and R&D

Investment in research and development (R&D) is seen as crucial for GE’s future. Experts emphasize the importance of fostering innovation to stay competitive, particularly in high-tech industries like aviation and healthcare.

GE’s commitment to developing cutting-edge technologies, such as artificial intelligence and digital solutions, is expected to drive long-term growth. Analysts believe that a strong focus on R&D will enable GE to differentiate itself and capture new market opportunities.

Long-term Strategic Vision

Experts agree that GE’s long-term strategic vision, which emphasizes sustainability, innovation, and operational excellence, is critical to its success.

The company’s leadership has articulated a clear plan to leverage its core competencies while exploring new avenues for growth. Analysts suggest that maintaining transparency and effective communication with investors will be key to fostering confidence and support for GE’s strategic initiatives.

How does GE perform compared to its competitors?

Financial Performance

Overview: GE’s financial health can be evaluated through metrics such as revenue, profit margins, and return on equity. Comparing these figures against competitors like Siemens, Honeywell, and ABB can provide insights into GE’s market position.

Comparison: In recent years, GE has faced challenges with its financial performance, particularly in its power division. While Siemens has demonstrated steady growth, GE’s revenue has fluctuated. Additionally, profit margins have often been tighter for GE, which affects its overall profitability when compared to Honeywell, known for higher margins.

Innovation and R&D

Overview: Innovation is crucial for long-term success in industrial sectors. GE invests significantly in research and development, focusing on cutting-edge technologies in energy, healthcare, and aviation.

Comparison: While GE has a strong legacy of innovation, competitors like Siemens and Honeywell are also investing heavily in R&D. Siemens, for example, has made strides in digital solutions and smart infrastructure, which positions them favorably in the market. GE must continue to innovate to maintain its competitive edge.

Market Share

Overview: Market share reflects a company’s competitiveness within its industry. Analyzing GE’s share in sectors like aviation, healthcare, and energy compared to competitors can reveal strengths and weaknesses.

Comparison: GE remains a leader in the aviation market, but its share in the power sector has been challenged by competitors such as Siemens and Mitsubishi. Understanding these dynamics helps clarify GE’s positioning in key industries.

Operational Efficiency

Overview: Operational efficiency indicates how well a company utilizes its resources to generate profit. Metrics like productivity rates and cost management are essential in this analysis.

Comparison: GE has faced scrutiny over operational inefficiencies, particularly in its legacy businesses. In contrast, Honeywell has been praised for its operational discipline, often leading to higher returns. GE needs to enhance its efficiency to compete effectively.

Customer Satisfaction

Overview: Customer satisfaction is a vital indicator of a company’s reputation and potential for repeat business. Evaluating feedback and ratings from clients can provide insights into GE’s standing in comparison to its peers.

Comparison: GE has traditionally held strong relationships with customers, especially in aviation and healthcare. However, competitors like Siemens have made significant gains in customer satisfaction through enhanced service offerings. Continuous improvement in customer engagement will be critical for GE.

What is GE’s current stock price?

Answer: As of the latest update, General Electric (GE) stock is priced at $167.97, reflecting a recent upsurge of 2.35%. Prices are subject to change, so checking Fintechzoom’s most recent data for up-to-date information is a good idea.

Current Stock Price:

The current stock price of $167.97 indicates the market value of one share of GE at this moment. Stock prices fluctuate throughout trading sessions due to various factors, including market demand, investor sentiment, and economic conditions. A higher stock price generally reflects greater investor confidence in the company’s future prospects.

Recent Upsurge

The noted increase of 2.35% signifies that the stock has risen in value compared to its previous trading session. This uptrend can result from positive news about the company, such as strong earnings reports, new product launches, or favorable market conditions. Understanding the reasons behind such movements can help investors make informed decisions.

Market Fluctuations

It’s important to note that stock prices are volatile and can change rapidly. Market dynamics such as trading volume, economic indicators, and geopolitical events can all contribute to price shifts. Investors should be aware that the price mentioned is current as of the latest update, but can vary significantly in a short period.

Reliable Sources for Updates

The recommendation to check Fintechzoom or similar financial news platforms highlights the importance of using reliable sources for up-to-date information. Financial websites provide real-time data, charts, and analysis that can help investors keep track of stock movements and make informed decisions.

Investment Considerations

Investors considering buying or selling GE shares should take into account not just the current price, but also other factors such as market trends, company performance, and individual investment strategies. Conducting thorough research and analysis is crucial in the stock market.

Recent Performance of GE Stock

Stock Price Trends

In recent months, GE stock has shown a notable increase, reflecting positive investor sentiment. The stock’s trajectory has been influenced by various factors, including quarterly earnings reports and market conditions. Analysts have observed fluctuations, but the overall trend indicates a recovery from previous lows, suggesting a return of confidence in the company’s future.

Earnings Reports

GE’s latest earnings report revealed stronger-than-expected revenue growth, primarily driven by its aviation and healthcare segments. This performance exceeded analysts’ forecasts, leading to a surge in stock price following the announcement. Investors responded positively, reflecting optimism about the company’s operational efficiency and growth strategies.

Strategic Initiatives

The company has implemented several strategic initiatives aimed at restructuring its operations and enhancing profitability. GE’s focus on its core industrial businesses, particularly in aviation and renewable energy, has been a critical factor in its recent stock performance. Investors have reacted favorably to these changes, which are expected to streamline operations and boost long-term growth prospects.

Market Conditions

The broader market conditions have also played a significant role in GE’s stock performance. As the economy shows signs of recovery post-pandemic, industrial stocks, including GE, have benefitted from increased demand for goods and services. Positive macroeconomic indicators, such as rising manufacturing activity, have further bolstered investor confidence in GE’s stock.

Analyst Ratings

Recent upgrades from analysts have contributed to the positive momentum of GE stock. Financial analysts have revised their ratings and price targets upward, reflecting improved forecasts for the company’s growth potential. This endorsement from financial experts has encouraged more investors to consider GE stock as a viable option, adding to the upward pressure on its price.

Challenges Ahead

Despite the positive performance, GE faces challenges that could impact its stock in the future. Supply chain disruptions and inflationary pressures are ongoing concerns that could affect profit margins. Additionally, the company must navigate a competitive landscape, particularly in its renewable energy segment, where rapid technological advancements and shifting regulations are constant challenges.

Detailed Analysis of GE’s Market Segments

Aviation

Overview: GE Aviation is a leading provider of jet engines, components, and integrated systems for commercial and military aircraft. It serves both original equipment manufacturers (OEMs) and the aftermarket.

Key Characteristics: The aviation market is characterized by high barriers to entry due to significant R&D investments and stringent regulatory requirements. GE Aviation focuses on innovation, developing fuel-efficient engines and advanced materials.

Trends: The trend towards more sustainable aviation solutions is driving investment in hybrid and electric propulsion technologies. Additionally, the demand for air travel is expected to grow, necessitating new aircraft and engine production.

Strategies: GE Aviation has invested in digital technologies, including predictive maintenance and data analytics, to improve operational efficiency and customer satisfaction. Partnerships with airlines for long-term service agreements are also a focus to ensure steady revenue streams.

Power

Overview: GE Power provides a wide range of technologies and services for electricity generation and distribution, focusing on gas, steam, and renewable energy.

Key Characteristics: The power segment is essential for global infrastructure, impacted by government policies on energy production and consumption. It includes traditional fossil fuel plants and a growing emphasis on renewable sources like wind and solar.

Trends: A major trend is the shift towards cleaner energy sources and carbon reduction. Governments worldwide are implementing regulations to lower emissions, creating a market for renewable energy solutions.

Strategies: GE Power is enhancing its portfolio by investing in renewable energy projects and integrating digital solutions to optimize grid management. The company focuses on sustainable technologies, such as combined-cycle gas plants, to reduce emissions.

Renewable Energy

Overview: GE Renewable Energy focuses on wind, hydro, and solar power technologies, positioning itself as a key player in the transition to sustainable energy.

Key Characteristics: This market segment is growing rapidly, driven by increasing demand for clean energy and government incentives. Wind and solar technologies are becoming more cost-competitive with traditional energy sources.

Trends: The trend toward decentralized energy production is rising, with more consumers and businesses investing in their renewable energy solutions. Innovations in energy storage and smart grid technologies are also shaping the market.

Strategies: GE Renewable Energy emphasizes technological advancements to increase efficiency and reduce costs. Strategic partnerships and acquisitions are pursued to expand its market reach and enhance product offerings.

Healthcare

Overview: GE Healthcare provides medical imaging equipment, monitoring devices, and diagnostic solutions to hospitals and clinics worldwide.

Key Characteristics: The healthcare market is characterized by rapid technological advancements and stringent regulatory standards. It includes a diverse product range, from imaging machines to patient monitoring systems.

Trends: A significant trend is the increasing focus on personalized medicine and advanced diagnostics. The demand for telehealth and remote monitoring solutions has surged, particularly following the COVID-19 pandemic.

Strategies: GE Healthcare invests heavily in research and development to drive innovation in imaging technologies and AI-driven diagnostics. Collaborations with healthcare providers are crucial to tailor solutions to meet specific patient needs.

Digital

Overview: GE Digital focuses on software and analytics solutions to optimize industrial operations, leveraging IoT and data analytics technologies.

Key Characteristics: This segment addresses the growing need for digital transformation across industries, enabling companies to enhance operational efficiency and reduce downtime.

Trends: The trend towards Industry 4.0 is driving demand for smart manufacturing solutions, predictive maintenance, and integrated software platforms. Companies are increasingly seeking data-driven insights to inform decision-making.

Strategies: GE Digital is expanding its software offerings and enhancing its cloud capabilities to facilitate seamless integration with existing systems. The company aims to establish itself as a leader in industrial IoT and analytics.

investment strategies for determining when to buy or sell GE stock

GE Stock Performance Analysis

Analyzing the performance of GE stock provides valuable insights into how the company has fared over time.

Historical Performance of GE Stock

Reviewing historical data allows investors to gauge trends and identify patterns in GE’s stock price movements. In the past few years, GE has faced both challenges and successes, shaping its current market valuation.

Latest GE Stock Market Trends

Keeping an eye on the latest trends is vital. Currently, GE stock has shown fluctuations influenced by economic factors, investor sentiment, and market dynamics.

GE Stock Price Forecast

Forecasting the future price of GE stock involves evaluating various financial indicators and market trends. Analysts provide forecasts based on current performance, historical data, and economic outlook.

GE Financial Reports & Earnings

Regular financial reports shed light on GE’s earnings, revenue, and expenses. Understanding these reports helps investors make informed decisions regarding their investments.

Impact of Economic Factors on GE Stock

Economic conditions significantly influence stock prices. Factors such as inflation, interest rates, and global market trends play a crucial role in determining GE’s stock value.

GE Competitor Analysis

Analyzing GE’s competitors provides a broader perspective on its market position. By comparing GE with other companies in the industrial sector, investors can assess its competitiveness and growth potential.

GE Stock Dividends and Returns

Investors often look for dividends as a measure of a company’s profitability. GE has a history of paying dividends, and analyzing its dividend policy helps in understanding shareholder returns.

GE Stock Investment Strategies

Investing in GE stock requires well-thought-out strategies. Factors such as risk tolerance, market conditions, and personal financial goals should guide investment decisions.

GE Stock Risk Factors

Like any investment, GE stock comes with its own set of risks. Identifying these risk factors is essential for investors looking to mitigate potential losses.

GE in the Industrial Sector

As a major player in the industrial sector, GE influences and is influenced by global market dynamics. Its role in industries such as aviation and energy makes it a stock to watch.

General Electric’s Leadership and Vision

Strong leadership and a clear vision for the future are critical for GE’s growth. Understanding the company’s management and strategic direction can provide insights into its long-term prospects.

Global Market Influence on GE Stock

Global economic trends affect GE’s stock performance. Monitoring international markets helps investors understand external factors that can impact GE’s valuation.

Who owns GE now?

Here’s an expanded breakdown of the information in a list table format:

| Point | Explanation |

|---|---|

| Company Name | GE Appliances |

| Industry | Home appliance manufacturing. GE Appliances produces a variety of household products including refrigerators, ovens, dishwashers, and more. |

| Location | Based in Louisville, Kentucky |

| Ownership | Majority owned by Haier |

| Parent Company | Haier is a Chinese multinational company specializing in home appliances and consumer electronics. |

| Acquisition Year | Since 2016: Haier acquired GE Appliances in 2016, marking a significant shift in ownership from American to Chinese control. |

| Significance of Acquisition | This acquisition allowed Haier to expand its presence in the North American market and leverage GE’s established brand and distribution network. |

| Current Operations | GE Appliances continues to operate under its brand name while benefiting from Haier’s resources and global supply chain. |

What is the structure of GE?

Electronic Configuration

- Definition: The electronic configuration describes the distribution of electrons in an atom’s orbitals.

- Configuration of Germanium:

- Notation: (Ar)(3d)¹⁰(4s)²(4p)²

- Components:

- (Ar): Represents the electron configuration of Argon, which has 18 electrons.

- (3d)¹⁰: Indicates there are 10 electrons in the 3d subshell.

- (4s)²: Indicates there are 2 electrons in the 4s subshell.

- (4p)²: Indicates there are 2 electrons in the 4p subshell.

- Total Electrons: The total number of electrons for germanium is 32 (18 from Argon + 10 from 3d + 2 from 4s + 2 from 4p).

Atomic Radius

- Definition: The atomic radius is a measure of the size of an atom.

- Atomic Radius of Germanium:

- Value: 0.137 nm (nanometers).

- Significance: This size indicates the distance from the nucleus to the outermost shell of electrons, influencing chemical bonding and properties.

Crystal Structure

- Definition: The crystal structure refers to the orderly geometric spatial arrangement of atoms in the crystalline solids.

- Type: Germanium has a diamond cubic crystal structure.

- Lattice Type:

- FCC (Face-Centered Cubic): The crystal structure can be visualized as having atoms at each corner and the centers of all the cube faces.

- Basis:

- Definition: The basis is the arrangement of atoms associated with each lattice point.

- Atoms in Basis:

- Atom 1: Located at (0, 0, 0) in unit cell coordinates.

- Atom 2: Located at (1/4, 1/4, 1/4) in unit cell coordinates.

- Significance: This arrangement contributes to the unique properties of germanium, such as its electrical conductivity and optical characteristics.

Unit Cell Dimensions

- Cube Edge: The size of the cube that defines the crystal lattice affects properties like density and atomic packing.

- Implications: The dimensions impact how germanium interacts with other materials and light, relevant in semiconductor applications.

GE’s Future Growth Potential

Investors often look for companies with growth potential. Evaluating GE’s strategies and market opportunities helps in assessing its future performance.

GE Stock Trends: An Overview

Current Trends in GE Stock

Price Movements and Volatility

GE stock has seen various price movements over recent months, reflecting broader market trends and company-specific developments. Observing these price movements helps investors understand the stock’s volatility and potential future behavior.

Market Sentiment

The overall market sentiment surrounding GE stock has fluctuated, influenced by factors such as earnings reports, strategic initiatives, and economic conditions. Keeping track of this sentiment provides insights into how investors perceive the stock.

Historical Performance Analysis

Long-term Performance

Analyzing GE’s long-term performance reveals patterns that can guide future investment decisions. Historical data can highlight periods of growth, stability, or decline, helping investors make informed choices.

Key Financial Metrics

Evaluating GE’s key financial metrics—such as revenue growth, profit margins, and debt levels—offers a clear picture of the company’s financial health. This analysis is crucial for assessing whether the stock is a viable investment option.

Investment Strategies for GE Stock

Long-term vs. Short-term Investing

Long-term Investment Approach

Investing in GE stock with a long-term perspective can yield significant returns, particularly if the company continues to execute its strategic plans effectively. This approach involves holding shares for an extended period, allowing for potential growth.

Short-term Trading Strategies

For those interested in short-term gains, utilizing trading strategies that capitalize on market volatility can be effective. These strategies involve buying and selling shares based on short-term price movements and market trends.

Diversification and Risk Management

Importance of Diversification

Incorporating GE stock into a diversified portfolio can help manage risk. A diversified approach reduces exposure to any single investment and provides a balanced investment strategy.

Risk Management Techniques

Employing risk management techniques—such as setting stop-loss orders and regularly reviewing your portfolio—can safeguard against potential losses in GE stock and enhance overall investment performance.

Performance Forecasts for GE Stock

Analyst Predictions

Market Analysts’ Insights

Analysts provide valuable insights and predictions regarding the future performance of GE stock. These forecasts are based on financial models, market conditions, and the company’s strategic direction.

Expected Growth Rates

Investors should consider expected growth rates for GE stock based on industry trends and company performance. Understanding these growth projections helps in making informed investment decisions.

Economic Factors Influencing Performance

Macro-economic Influences

The performance of GE stock is influenced by macroeconomic factors such as interest rates, inflation, and overall economic growth. Monitoring these factors can provide insights into potential future movements of the stock.

Industry-Specific Trends

Industry-specific trends also play a critical role in shaping GE’s stock performance. As industries evolve, companies like GE must adapt to changing market dynamics, which can impact their stock performance.

Exploring the Impact of Global Events on GME Stock

How Global Events Influence GME Stock

Economic Crises and GME Stock

Global economic crises, such as recessions or pandemics, can significantly impact GME stock. During times of economic uncertainty, consumer spending often declines, which can affect GameStop’s sales and, consequently, its stock performance. Monitoring these global events helps investors anticipate potential risks and opportunities.

Geopolitical Tensions

Geopolitical tensions, including trade wars and international conflicts, can create volatility in the stock market, including GME stock. Such tensions can disrupt supply chains, impact consumer confidence, and lead to broader market sell-offs, affecting the overall performance of stocks in the retail sector.

Market Reactions to Global Events

Investor Sentiment Shifts

Global events can lead to rapid shifts in investor sentiment. Events like elections, natural disasters, or significant policy changes can create uncertainty, influencing how investors perceive GME stock. Keeping track of these sentiments is crucial for understanding potential stock movements.

Stock Market Volatility

GME stock is often subject to increased volatility during global events. Understanding the historical reactions of GME stock to such events can help investors make informed decisions during turbulent times.

Evaluating Competitive Positioning within the Industry

Competitive Landscape Analysis

Key Competitors

To effectively assess GME stock, it’s essential to analyze its key competitors within the gaming and retail sectors. Competitors such as Amazon, Best Buy, and various online gaming platforms have a significant impact on GameStop’s market share and pricing strategies.

Market Positioning

Understanding GME’s market positioning helps evaluate its strengths and weaknesses. GameStop’s focus on retail and digital gaming solutions sets it apart, but it also faces challenges from online competitors and changing consumer preferences.

Industry Trends Impacting GME

Technological Advancements

The gaming industry is rapidly evolving, with advancements in technology influencing how games are sold and consumed. Staying abreast of these trends is essential for understanding GME’s position in the market.

Shifts in Consumer Behavior

Changes in consumer behavior, such as the rise of digital downloads over physical game sales, can significantly affect GME stock performance. Investors should monitor these shifts to gauge GME’s adaptability and growth potential.

Strategies for Long-Term Value Creation in GME Stock Investment

Focusing on Fundamentals

Analyzing Financial Health

Investors should focus on analyzing GME’s financial health, including revenue growth, profitability, and cash flow management. A solid financial foundation is critical for long-term value creation.

Evaluating Growth Potential

Assessing GME’s growth potential involves looking at its strategic initiatives, such as expanding digital offerings and improving customer experience. Investors should consider how these factors contribute to long-term value.

Diversification and Risk Management

Diversifying Investments

Diversifying investments beyond GME stock can help mitigate risk. A well-balanced portfolio allows investors to manage volatility while seeking potential growth in different sectors.

Risk Assessment

Regularly assessing risks associated with GME stock, including market competition and economic factors, can inform investment strategies. This proactive approach aids in making informed decisions that align with long-term goals.

Keeping Abreast of Market Trends

Monitoring Market Developments

Investors should continuously monitor market developments and trends impacting GME stock. Staying informed about industry news, competitor actions, and broader economic indicators is essential for adapting investment strategies.

Leveraging Analyst Insights

Utilizing insights from financial analysts can provide valuable perspectives on GME stock. Analysts’ recommendations and forecasts help investors understand market dynamics and make informed choices.

How do analysts feel about the stock of GE?

GE Aerospace’s average price target is $198.58. This is based on twelve 12-month price targets released by Wall Street analysts during the previous three months. The lowest estimate is $180.00, while the maximum analyst price goal is $215.00. From the current price of $178.28, the average price goal reflects an increase of 11.39%.

Now, is GE stock a wise investment?

Sixteen Wall Street analysts that follow GE (NYSE: GE) agree that the stock is a Strong Buy.

What is the projected 2024 price of GE stock?

The price of a share of #GE is $184.87 on September 19, 2024. Forecasts for 2024. It is anticipated that the price of General Electric stock will rise, with a range of $166 to $194.

Conclusion

In conclusion, the analysis of GE stock amidst current market trends reveals a complex yet promising landscape. While challenges persist, strategic initiatives and market recovery signals may position GE favorably for long-term growth. Investors are encouraged to stay informed and consider both the potential rewards and risks associated with investing in GE.

FAQs, FintechZoom GE Stock Analysis

1. What is FintechZoom, and how does it provide stock analysis for GE?

FintechZoom is a financial news and analysis platform that covers a broad range of topics, including stock market trends, cryptocurrency, financial technology, and stock analysis. For GE (General Electric) stock analysis, FintechZoom offers insights into the stock’s historical performance, financial reports, earnings, and market sentiment. It also provides updates on key events that could impact GE’s stock price.

2. What kind of GE stock information can I find on FintechZoom?

On FintechZoom, you can access a variety of information about GE stock, including:

Real-time stock price updates

Technical analysis charts

GE’s financial reports (e.g., earnings, revenue)

News affecting GE’s stock performance

Expert opinions and market outlooks

Dividend history and yield

3. How accurate is the stock analysis provided by FintechZoom for GE?

FintechZoom aggregates data and analysis from various trusted financial sources and experts, but like any financial tool, its analysis should be used as a part of broader research. Stock predictions are based on historical data, trends, and market conditions, and they are subject to change due to unforeseen events.

4. Can I rely solely on FintechZoom’s GE stock analysis for investment decisions?

While FintechZoom provides valuable insights into GE stock, it’s important not to rely solely on one source for investment decisions. Investors should consider additional research, consult financial advisors, and review various financial analysis platforms before making any stock market moves.

5. Does FintechZoom offer recommendations or predictions for GE stock?

FintechZoom doesn’t offer specific buy or sell recommendations for GE stock. However, it provides data, charts, and expert opinions that can help investors make informed decisions. Users can view analyst ratings, earnings forecasts, and technical indicators for GE stock trends.

One Comment