What Stock Is Worth 35 Amazons Gumshoe – Deep Info

Introduction

In the ever-evolving landscape of the stock market, investors are constantly on the lookout for high-value opportunities. Recently, a particular stock has captured attention with a valuation said to be worth 35 times that of Amazon. This intriguing claim has stirred curiosity and speculation. In this article, we delve into the latest findings from Gumshoe, analyzing the market value of this stock and what it could mean for potential investors.

Understanding the Stock Market

What is a Stock?

A stock, also known as a share or equity, represents a fractional ownership in a company. When you buy a stock, you are essentially purchasing a small piece of the company, which entitles you to a portion of its assets and earnings. This ownership stake means that you have a claim on the company’s profits and can benefit from its financial success. Conversely, you also share in the risks, including potential losses if the company performs poorly.

Ownership and Shares

Each stock represents a unit of ownership in the company. Companies issue shares of stock to raise capital for various purposes, such as expanding their operations, investing in research and development, or paying off debt.

When you purchase shares, you become a shareholder, which often grants you certain rights. These rights can include voting on corporate matters, receiving dividends (a share of the company’s profits), and selling your shares on the open market.

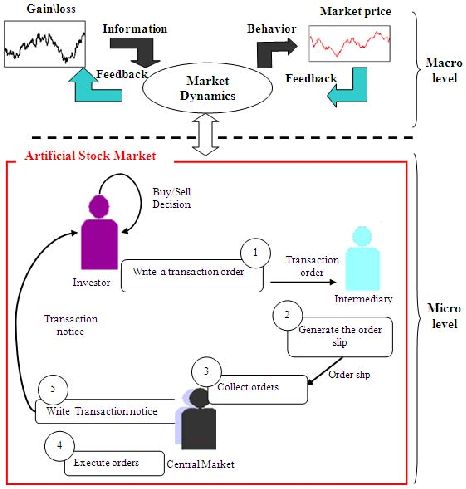

Stock Market Dynamics

Stocks are bought and sold on stock exchanges, such as the New York Stock Exchange (NYSE) or the Nasdaq. The stock market functions as a marketplace where buyers and sellers come together to trade shares. The prices of stocks fluctuate based on a variety of factors, including:

Market Trends: Overall economic conditions and investor sentiment can drive stock prices up or down. Bull markets, characterized by rising stock prices, can boost valuations, while bear markets, marked by declining prices, can lead to lower valuations.

Company Performance: A company’s financial health, including its earnings reports, revenue growth, and profitability, heavily influences its stock price. Positive performance can attract investors, driving up the stock price, while poor performance can lead to a decline.

Economic Indicators: Broader economic indicators, such as interest rates, inflation, and employment rates, can also impact stock prices. For example, higher interest rates might lead to higher borrowing costs for companies, potentially impacting their profitability and stock values.

Stock Price Fluctuations

Stock prices are not static and can change frequently throughout the trading day. These fluctuations are driven by supply and demand dynamics in the market.

If more people want to buy a stock than sell it, the price tends to rise. Conversely, if more people want to sell a stock than buy it, the price tends to fall. This constant interplay between buyers and sellers helps determine the fair market value of a stock at any given time.

Investment Strategies

Investors use various strategies to make the most of their stock investments. Some may focus on short-term trading to capitalize on market fluctuations, while others may adopt a long-term approach, investing in companies they believe will grow over time.

Understanding these strategies and how they relate to stock market dynamics can help investors make informed decisions and manage their investment portfolios effectively.

What Makes a Stock Valuable?

The value of a stock is influenced by several key factors that investors and analysts closely monitor. Here’s a deeper look into what makes a stock valuable:

Company Earnings

One of the primary indicators of a stock’s value is the company’s earnings. Earnings refer to the company’s profits, which are reported in financial statements such as the income statement. Strong and consistent earnings often signal a healthy and profitable company, making its stock more attractive to investors.

Market Conditions

The broader market conditions play a significant role in determining a stock’s value. Factors such as economic growth, interest rates, and overall market sentiment can impact stock prices. For example, in a booming economy with low-interest rates, stocks might be valued higher due to increased investor confidence and spending.

Investor Sentiment

Investor sentiment, or how investors feel about a company and the market in general, can also affect stock value. Positive sentiment can drive up stock prices as investors are willing to pay more for shares based on future expectations. Conversely, negative sentiment can lead to lower stock prices.

Financial Performance

A company’s financial performance, including revenue growth, profit margins, and return on equity, is crucial for determining stock value. Companies that demonstrate strong financial metrics and efficient operations are often seen as valuable investments.

Growth Potential

Stocks with high growth potential are typically valued higher. Investors look for companies with promising future prospects, such as innovative products, expanding markets, or strategic advantages that could drive future earnings.

Market Position

The company’s position within its industry can influence its stock value. A leading company with a competitive edge or a strong market share is likely to have a higher stock value compared to its peers.

Valuation Metrics

Common valuation metrics used to assess a stock’s value include the Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and Dividend Yield. These metrics help investors gauge whether a stock is overvalued, undervalued, or fairly priced relative to its earnings and book value.

By considering these factors, investors can make more informed decisions about the value of a stock and its potential as an investment.

The Claim: Stock Worth 35 Amazons

The assertion that a stock is worth 35 times Amazon’s valuation is both dramatic and intriguing. To put this in perspective:

- Amazon’s Valuation: Amazon, being one of the largest companies globally, has a substantial market cap, reflecting its enormous value and influence.

- Target Stock Comparison: If another stock is worth 35 times more than Amazon, it implies an exceptionally high market valuation or a unique investment opportunity. This could indicate a company with extraordinary potential or an undervalued stock compared to its actual worth.

Understanding the reasons behind this valuation requires a closer look at the target company’s financials, market position, and growth prospects.

Gumshoe Findings

Gumshoe Analysis Methodology

Gumshoe, known for its in-depth investment research, has recently highlighted a stock with remarkable potential. Their analysis utilizes various financial metrics and market data to identify high-value investment opportunities.

The Claim: Stock Worth 35 Amazons

According to the latest Gumshoe findings, there is a stock that holds a valuation equivalent to 35 times that of Amazon. This bold assertion raises questions about the company’s financial health and growth prospects.

Market Comparison: Amazon vs. the Target Stock

Amazon’s Market Position

Amazon, a global e-commerce and technology giant, is renowned for its robust market presence and significant stock value. Understanding Amazon’s market position helps in comparing its value with the stock in question.

Comparing Market Values

The comparison involves analyzing the target stock’s market cap against Amazon’s valuation. This section provides insights into how the two stocks stack up in terms of market value and investment potential.

Investment Insights

What Does This Mean for Investors?

For investors, the claim of a stock being worth 35 Amazons presents a unique opportunity. This could indicate a high-growth potential or a significant undervaluation of the target company.

Evaluating Investment Opportunities

Investors should consider various factors such as the company’s financial health, growth projections, and market conditions before making investment decisions. The stock’s potential as an investment opportunity in 2024 is crucial for decision-making.

Tools for Analysis

Market Analysis Tools

Utilizing market analysis tools can provide valuable insights into stock performance. These tools help investors understand market trends and make informed decisions.

Financial Analysis Tools

Financial analysis tools assess a company’s financial statements and metrics. They are essential for evaluating the value and potential of a stock.

Detailed Analysis of the Target Stock

Financial Health of the Target Company

To assess the value of the stock in question, it’s crucial to examine the company’s financial health. This includes analyzing key financial statements such as the balance sheet, income statement, and cash flow statement. Key metrics to consider include:

- Revenue and Earnings Growth: Consistent growth in revenue and earnings can indicate a strong and stable company.

- Profit Margins: High profit margins suggest efficient operations and profitability.

- Debt Levels: A company with manageable debt levels is generally considered less risky.

Market Position and Competitive Advantage

Understanding the target company’s market position and competitive advantage is essential. Key factors to evaluate include:

- Market Share: A larger market share often indicates a dominant position in the industry.

- Unique Selling Proposition (USP): A strong USP can provide a competitive edge and drive future growth.

- Industry Trends: Identifying industry trends can help predict how the company might perform in the future.

Growth Potential and Future Prospects

Evaluating the growth potential of the target stock involves looking at:

- Expansion Plans: Companies with aggressive expansion plans may offer higher growth potential.

- Innovation and R&D: Investment in research and development can lead to new products and services, driving future growth.

- Market Opportunities: Emerging markets or new sectors can present opportunities for growth.

Investment Opportunities in 2024

High-Value Stocks to Watch

Investors looking for high-value stocks in 2024 should consider:

- Emerging Technologies: Stocks in sectors like artificial intelligence, renewable energy, and biotechnology could offer substantial growth.

- Established Giants: Companies with a solid track record and strong market position, similar to Amazon, remain attractive.

- Undervalued Stocks: Identifying stocks that are undervalued relative to their potential can lead to significant investment gains.

Top Stocks to Invest In

Here are some criteria for selecting top stocks:

- Strong Financials: Look for companies with robust financial performance.

- Growth Potential: Prioritize companies with promising growth prospects.

- Market Position: Consider stocks with a strong competitive position and market presence.

Stock Market Insights

Latest Stock Findings

Recent stock market findings highlight several key trends:

- Volatility: Stock markets are experiencing increased volatility, which can present both risks and opportunities.

- Sector Performance: Certain sectors are performing better than others, influenced by economic conditions and technological advancements.

Stock Worth Comparison

Comparing stocks based on their worth involves:

- Valuation Metrics: Utilize valuation metrics like Price-to-Earnings (P/E) ratio and Price-to-Book (P/B) ratio.

- Performance Analysis: Assess historical performance to gauge potential future returns.

- Risk Assessment: Consider the risk factors associated with each stock to make informed decisions.

Financial Analysis Tools

Market Analysis Tools

Effective market analysis tools include:

- Stock Screeners: Tools that help identify stocks based on specific criteria.

- Technical Analysis Software: Programs that analyze stock price movements and trends.

- Market Research Reports: Comprehensive reports that provide insights into market conditions and trends.

Financial Analysis Tools

Key financial analysis tools to consider:

- Ratio Analysis: Techniques to evaluate financial ratios like liquidity, profitability, and solvency.

- Forecasting Models: Models that project future financial performance based on historical data and market trends.

- Valuation Models: Methods such as Discounted Cash Flow (DCF) and Comparable Company Analysis (CCA) to determine stock value.

Conclusion

The claim that a stock is worth 35 times that of Amazon is a significant assertion that warrants careful analysis. By examining the financial health, market position, and growth potential of the target stock, investors can gain a clearer understanding of its value. Utilizing market and financial analysis tools further aids in making informed investment decisions.

In summary, the target stock presents an intriguing opportunity, and understanding its valuation in comparison to established giants like Amazon can provide valuable insights for potential investors.

FAQ What stock is worth 35 Amazons Gumshoe

What does “35 Amazons” mean in stock terms?

The term “35 Amazons” is a reference used by stock analysts, particularly Gumshoe (a stock commentary site), to describe a stock or investment opportunity that is projected to have the potential of becoming as valuable as 35 times Amazon’s value. This is typically used in a hyperbolic sense to emphasize immense growth potential.

Who or what is Gumshoe?

Stock Gumshoe is an independent site that analyzes and investigates stock teasers, newsletters, and investment pitches. It helps investors decode the promises and claims made in stock promotions.

What stock is currently being referred to as “worth 35 Amazons”?

Specific stock names are often kept a mystery in investment pitches until you sign up for a newsletter or service. However, analysts on platforms like Stock Gumshoe often speculate or identify certain tech stocks, biotech companies, or disruptive innovations that could fit such a description.

How can I find out what stock is being teased as “worth 35 Amazons”?

To discover the stock being teased, you can follow Gumshoe’s analysis or subscribe to the specific investment newsletter making the claim. Often, such newsletters promise information about high-growth stocks in return for a subscription fee.

Is it safe to invest in stocks teased as “worth 35 Amazons”?

Like all investments, stocks being hyped with high-growth potential carry risk. It’s crucial to research thoroughly and consult with financial professionals before investing in speculative stocks.

What industries typically feature stocks with such high-growth potential?

Stocks with potential for massive growth often come from sectors like technology, biotechnology, artificial intelligence, and other disruptive industries.